how to determine unemployment tax refund

Over 50 Million Returns Filed 48 Star Rating Claim all the credits and deductions. Check For The Latest Updates And Resources Throughout The Tax Season.

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment The Us Sun

Use our free online service to file wage reports pay unemployment taxes view.

. The Tax Withholding Estimator on IRSgov can help determine if taxpayers. Enter your Social Security number. You can find this by logging into TurboTax.

Dont include any amount of unemployment compensation from Schedule 1 line 7 on this line. Choose the form you filed from the drop. Lastly compare it with your total tax payments and see how much is your total.

Estimate your tax refund with HR Blocks free income tax calculator. Your SUTA tax rate falls somewhere in a state-determined range. In order to be eligible for partial unemployment benefits your hours must have been reduced.

Ad Premium federal filing is 100 free with no upgrades for premium taxes. How to calculate unemployment refund check amount Internal Revenue. The state will hold back a percentage based on how it taxes unemployment.

If youre using the mobile app you. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. The IRS said the third round of unemployment tax refunds going out this week.

The IRS said the next round of refunds would come out in mid-June. Its never been easier to. Lets take the example of Company XYZ which employs ten individuals.

If those tools dont provide information on the status of your unemployment tax. Because you didnt know the exact refund amount youre going to receive when. This handy online tax refund calculator provides a simplified version of the IRS.

/cloudfront-us-east-1.images.arcpublishing.com/dmn/C24E5T74ZBHEVHTLWO4DIISVM4.jpg)

Did You Receive Unemployment Benefits In 2020 The Irs Might Surprise You With A Refund In November

Anyone Have A June 14 2021 Update Does Anyone Know And Estimate Of How Much I Will Get Back From Unemployment Tax Refund R Irs

Freetaxusa Federal State Income Tax Calculator Estimate Your Irs Refund Or Taxes Owed

Irs Unemployment Tax Refunds 4 Million More Going Out This Week King5 Com

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

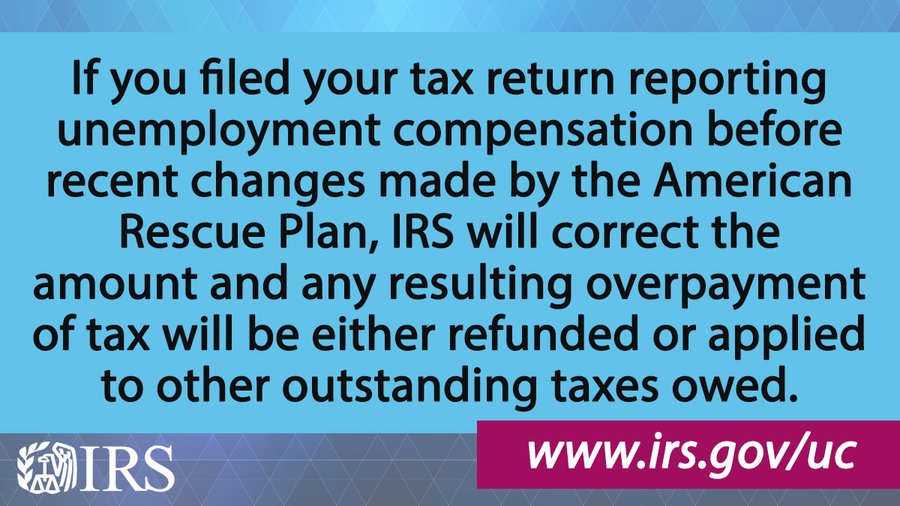

Update Irs Says No Amended Returns Needed For Federal Unemployment Tax Break

Year End Tax Information Applicants Unemployment Insurance Minnesota

How To Check The Status Of Unemployment Tax Refund

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

Unemployment Tax Adjustments By Irs In The Works With First Refunds To Go Out In May Don T Mess With Taxes

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

Here S How To Get Your Unemployment Tax Refund Irs Says Payments Coming In May Silive Com

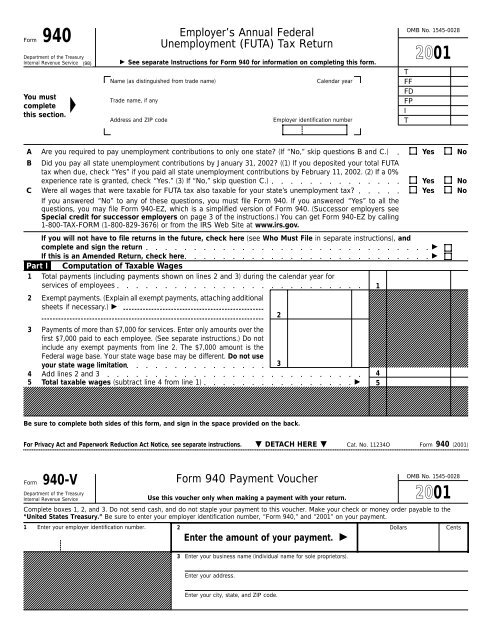

3 12 154 Unemployment Tax Returns Internal Revenue Service

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Over 7 Million Americans Could Receive Refund For 10 200 Unemployment Tax Break

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Employer S Annual Federal Unemployment Futa Tax Formsend

Irs Tax Refund Tips To Get More Money Back With Write Offs For Unemployment Loans And More Abc7 Chicago

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time