south dakota property tax laws

The last thing you want to deal with is missing a tax payment. Title 10 Codified Laws on Taxation.

Regardless of whether a person dies with a valid will testate or without a valid will intestate their estate will pass through probate.

. The basic provisions of South Dakotas tenant rights laws including anti-discrimination laws deadlines for the return of security deposits and more. If the county is at 100 fair market value the. Aside from inheritance and estate taxes South Dakota is generally a tax friendly state.

86-272 or the Interstate Income Act of 1959 a federal law designed to protect businesses from income tax liability in a state where they have no property or employees. The statewide rate is 450 and most. Major rewrite of the property tax laws through SB 12 and SB 15.

South Dakota does not levy several taxes that other states impose such as a state income tax. Some of the changes included. For example d some states may tax trust distributions originating from a South Dakota residents trust if the distributions.

South Dakota Codified Laws 43-31. Dlrrealestatestatesdus DLR Home State Home Equal Opportunity Accessibility Policy Contact Us. Like hotel and BB stays short-term rentals in South Dakota are subject to tax.

Businesses who would like to apply for reinstatement with the Secretary of States office must first receive a tax clearance certificate from the Department of Revenue. Tax authorities require short-term vacation rental hosts to collect applicable short-term rental taxes from their guests and remit them to the proper authorities. If a condominium or homeowners association is organized as a nonprofit corporation it will be governed by the Act.

128 of home value. General Property Tax Rules. Failure to comply with state and local tax laws can result in fines and interest penalties.

SDCL 10-5 Situs of Property for Taxation. Counties in South Dakota collect an average of 128 of a propertys assesed fair market value as property tax per year. Section 10-6B-7 - Amount of reduction of real property taxes due for a multiple-member household.

SDCL 10-1 Department of Revenue. South Dakota is ranked number twenty seven out of the. Property Tax Codified Laws.

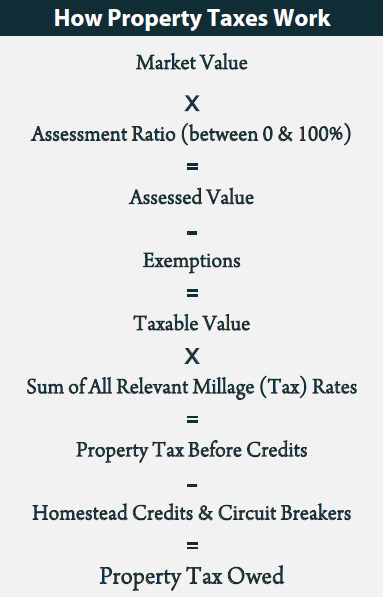

The property tax is an ad valorem tax on all property that has been deemed taxable by the South Dakota Legislature. Article 2069 - Real Estate Brokers and Salespersons 217 W. SDCL 10-18A-1 to 10-18A-7 states that certain low income property owners are eligible for a property tax refund and should check with their county treasurer for details and assistance in making application.

Section 10-6B-8 - Eligibility of head of household for reduction. South Dakota Probate and Estate Tax Laws. To qualify the following conditions must be met.

You Dont Have To Solve This on Your Own Get a Lawyers Help. Rules Concerning the Certification of Assessing Officers. 6057733600 For TTY services call 711 Fax.

If someone from another state leaves you an inheritance check local laws. Tax Breaks and Reductions. 2022 - SD Legislative Research Council LRC Homepage SD Homepage.

SDCL 10-6 Annual Assessment of Property. - Pierre SD 57501 Phone. The law governs the corporate structure and procedure of nonprofit corporations in South Dakota.

The MTCs new interpretation pretends to adhere to the. The Property Tax Division is responsible for overseeing South Dakotas property tax system including property tax assessments property tax levies and all property tax laws. Under South Dakota law SDCL 10-6-131 landowners may submit a Request for Ag Land Adjustment to the Director of Equalization in the county the land is located in.

State law provides several means to reduce the tax burden of senior citizens. The State of South Dakota does not levy or collect any real property taxes. Most of South Dakotas property tax laws are codified in various chapters of Title 10 of the South Dakota Codified Laws.

The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000. Rather property taxes are imposed by your local cities schools counties and townships and are collected by your local county treasurer. Probate is the administrative process by which the deceaseds property both personal and land are collected and distributed to the deceaseds heirs and devisees.

Sales tax is low in South Dakota. Most of South Dakotas property tax laws are codified in various chapters of Title 10 of the South Dakota Codified Laws. Section 10-6B-1 - Definition of terms.

South Dakota Nonprofit Corporation Act SD. Administrative Rules of South Dakota ARSD Regulated by the Commission. 2021 South Dakota Codified Laws Title 10 - Taxation Chapter 06B - Property Tax Reduction From Municipal Taxes For The Elderly And Disabled.

Find a variety of tools and services to help you file pay and navigate South Dakota tax laws and regulations. So even money you earn from a post-retirement job wont be taxed by the state. Pdf California recently decided to become the first state to follow the Multistate Tax Commission MTC in its new interpretation of PL.

Visit the South Dakota Secretary of State to find an. The authority to levy property taxes The County Director of Equalization DOE assesses the value of all. Laws 47-22-1 et seq.

South Dakota laws require the property to be equalized to 85 for property tax purposes. 43-31-1 Homestead exempt from judicial sale judgment lien and mesne or final process--Mobile homes--Senior citizens. 43-31-2 Homestead limited to house or mobile home and appurtenant buildings--Business place--Minimum size of mobile home.

Inheritance taxes are imposed upon the deceaseds heirs after they have received their inheritance. Ad valorem refers to a tax imposed on the value of something as opposed to quantity or. Tax amount varies by county.

Legislative Research Council 500 East Capitol Avenue Pierre SD 57501. SDCL10-4 Property Subject to Taxation. However other states may tax people or property within South Dakota baseon those states laws.

43-31-3 Homestead containing one or more lots or tracts of land--Contiguous tracts--Use in good faith. Sales and property tax refunds and property tax freezes are available to seniors who meet the qualifications. The property tax system in South Dakota consists of two parts.

South Dakota also does not levy the gift tax but the federal gift tax applies on gifts totaling more than 15000 in one calendar year. The head of the household must be sixty-five years of age or older or shall be disabled prior to January first of the year in. South Dakotas average effective property tax.

Meeting with a lawyer can help you understand your options and how to best protect your rights. South Dakota Tenant Rights Laws. There is no authority in state law that allows for a deferment or a delay of the property tax payment deadlines.

Taxpayer Bill of Rights.

Understanding Your Property Tax Statement Cass County Nd

Property Tax Comparison By State For Cross State Businesses

Little Known Tax Advantage Benefits Minnesota Businesses Finance Commerce

A Breakdown Of 2022 Property Tax By State

Property Tax South Dakota Department Of Revenue

Understanding Your Property Tax Statement Cass County Nd

Property Tax South Dakota Department Of Revenue

Colorado Property Tax Calculator Smartasset

Property Tax Homestead Exemptions Itep

Property Taxes By State County Lowest Property Taxes In The Us Mapped

The Effect Of Tax Laws On Commercial Real Estate Cyber Security Education Legit Work From Home School

Assessment Freeze For The Elderly Disabled South Dakota Department Of Revenue

How Taxes On Property Owned In Another State Work For 2022

Property Tax South Dakota Department Of Revenue

Texas Taxable Services Security Services Company Medical Transcriptionist Internet Advertising

How Is Tax Liability Calculated Common Tax Questions Answered

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)